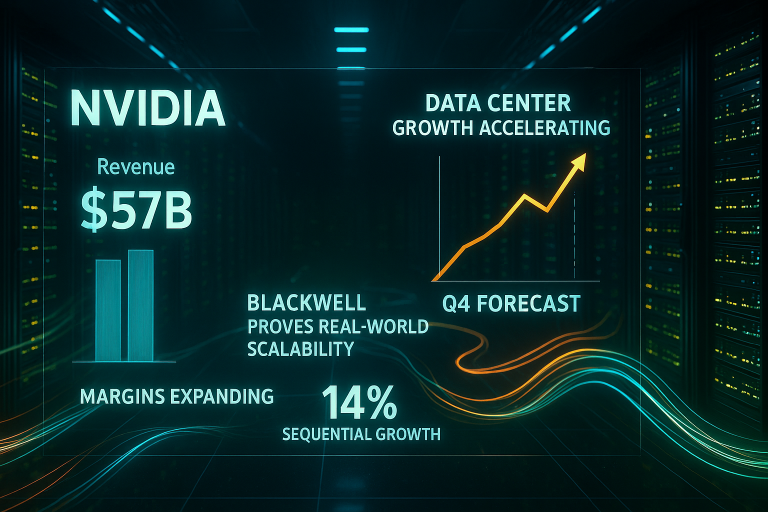

The US stock market is on edge today as investors focus on Thursday’s crash following the strong Nvidia earnings. Futures tied to the Dow Jones rose by 0.40%, while those linked to the Nasdaq 100 and S&P 500 indices barely moved.

US stock market attempts to rebuild

The US stock market is under intense pressure after the top indices reversed and crashed on Friday. The Dow Jones Index dropped by 388 points, while the S&P 500, Nasdaq 100, and the Russell 2000 indices dropped by 1.55%, 2.15%, and 1.8%, respectively.

This crash was mostly driven by technology companies, especially those linked to the artificial intelligence sector. For example, Micron stock price dropped by 10.8%, while Robinhood, Datadog, Western Digital, AMD, Palo Alto, and Seagate were among the top laggards.

Therefore, the hope is that the stock market will rebound as investors buy the dip or as a dead-cat bounce happens. A dead-cat bounce is a situation where an asset in a freefall bounces back briefly and then resumes the downtrend.

Federal Reserve speakers in focus

The US stock market will also react to statements from some Federal Reserve officials as divisions on policy emerge.

Michael Barr, a top Fed governor, will talk today, a day after he warned about more interest rate cuts, now that inflation remains stubbornly above the 2% target. The most recent date showed that the headline Consumer Price Index (CPI) rose to 3% in September.

John Williams, the head for New York Fed, will also talk and deliver his views on the economy and the next monetary policy meeting. In his recent statement, he maintained a dovish tone, citing the financial strain among lower and middle-income Americans. He suggested that the bank may restart quantitative easing soon.

The other Federal Reserve officials who will talk today are Susan Collins, Lorie Logan, and Philip Jefferson.

Traders on Polymarket believe that the bank will cut interest rates by 0.25% in the upcoming meeting. Odds of a cut have remained at 69%, higher than this week’s low of 50%.

Warner Bros. Discovery acquisition progress

The other important catalyst for the US stock market today will be progress on the Warner Bros. Discovery (WBD). The WBD stock price jumped by over 1% after the Wall Street Journal reported that companies like Paramount, Comcast, and Netflix had submitted bids for the company.

Analysts believe that Paramount has a better chance of buying the company because it is the only one interested in the entire company. Also, the deal has a higher chance of being accepted by the Trump administration, which has a good relationship with Larry Ellison.

A potential deal for the company will be a big one as it now has a market capitalization of over $56 billion, as the stock jumped by 140% in the last 12 months.

Ukraine and Russia news

The other minor catalysts for the stock market will be the new developments on the Russian-Ukraine war. Donald Trump is pressing Ukraine to accept a deal with substantial concessions, including ceding land to Russia and limiting the size of the military.

The potential deal explains why the price of crude oil is tanking, with Brent and West Texas Intermediate (WTI) falling by over 2% to $62 and $57.

The main stocks to watch today will be companies in the AI industry. Also companies like BitMine, Mara Holdings, Bitfarms, and MSTR will be in the spotlight as the crypto market crashes.

The post Top news to drive the US stock market today appeared first on Invezz