Rolls-Royce share price surged to a record high this year, continuing a trend that has been going on for years. It jumped to a record high of 1,305p on Monday, bringing the year-to-date gains to 11%, making it one of the best-performing companies in the FTSE 100 Index.

Why the Rolls-Royce share price has soared

Rolls-Royce Holdings stock has soared by 1,300% in the last five years, bringing its market capitalization to over $143 billion, making it the fifth biggest company in the UK after AstraZeneca, HSBC, Linde, and Shell. It has overtaken companies like Unilever, Rio Tinto, and British American Tobacco.

Rolls-Royce’s surge mirrors the performance of other top industrial companies like BAE Systems, Babcock, GE Aerospace, and Melrose Industries.

One reason for this is that the company has a large defence business at a time when geopolitical risks are rising. Trump recently kidnapped Venezuela’s Nicolas Maduro and has threatened to attack Greenland.

At the same time, he has hinted that he will launch an attack on Iran, where protests have continued in the past three weeks. Trump has also maintained that the US will boost its defense spending from nearly $1 trillion to $1.5 trillion.

Defense spending is also accelerating in Europe, where Trump has pushed countries to boost defense spending to 5%. This is important because the company is a major defense contractor, making engines for fighter jets and nuclear submarine propulsion systems.

Rolls-Royce share price has also soared because of its small modular nuclear reactor business. Analysts believe that this business has more room to run, especially after the recent deal between Oklo and Meta Platforms. The deal will see Oklo providing reliable nuclear power to AI data centers.

Therefore, there is a likelihood that Rolls-Royce will also gain some of these contracts in the future. Besides, it is one of the most experienced companies in the nuclear industry.

Aviation industry is booming

Rolls-Royce’s share price also continued to do well because of the aviation industry, which will continue doing well this year. A recent report by IATA showed that air traffic will grow by 4.9% this year, continuing a trend that started after the pandemic.

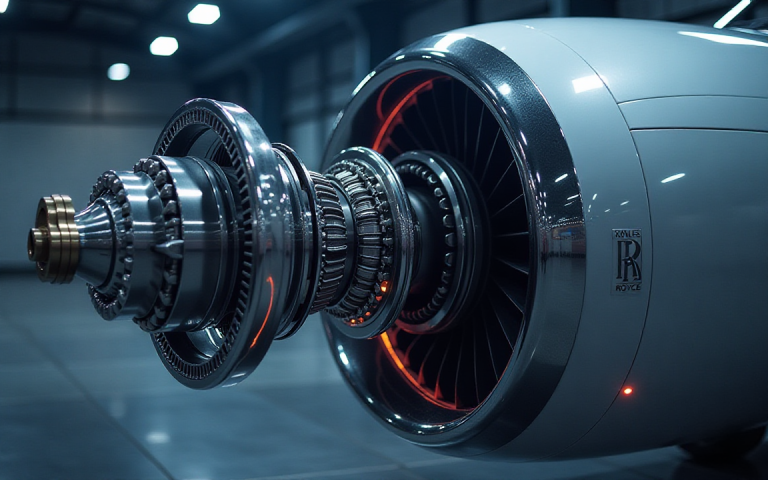

Rolls-Royce is one of the biggest players in the aviation industry, where it makes engines known as Trent and UltraFan. Its engines are mostly used in aircraft like Boeing 787 and Airbus A350.

Analysts believe that the company’s growth will continue this year, with its operating profit and cash flow soaring. The company’s guidance is for the two metrics to be between £3.1 billion and £3.2 billion and between £3 billion and £3.1 billion, respectively. Chances are that its numbers will be better than its guidance.

It has also continued to reward its shareholders, including with a £200 million buyback announced in December.

Rolls-Royce share price technical analysis

The daily chart shows that the Rolls Royce share price has rebounded in the past few weeks. It has soared from a low of 1,020p in December to 1,287p today.

The stock has moved above the key resistance level at 1,192p, the neckline of the inverted head-and-shoulders pattern, a common bullish reversal sign.

The stock remains above the 50-day and 200-day Exponential Moving Averages and the Supertrend indicator. Additionally, the Relative Strength Index (RSI) and the Average Directional Index (ADX) have continued rising.

Therefore, the most likely scenario is where the stock continues rising as bulls target the key resistance level at 1,500p. Another alternative is where the stock drops and retests the support at 1,192p and then resumes the uptrend to 1,500p.

The post Rolls-Royce share price rally gains steam: can it hit 1,500p? appeared first on Invezz