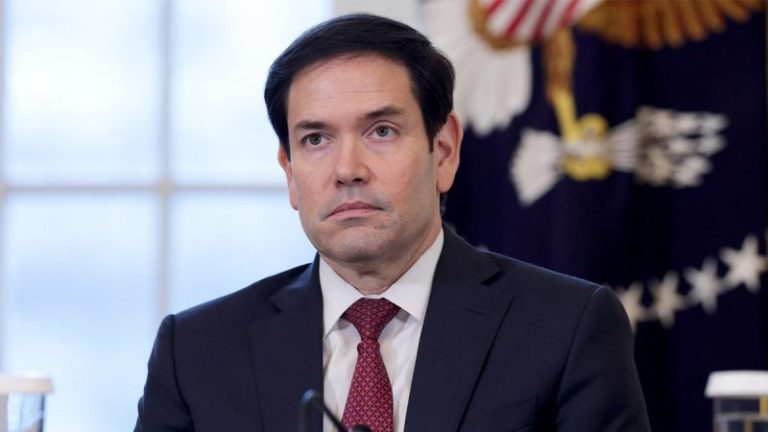

President Donald Trump credits Secretary of State Marco Rubio as the one for training him to become a diplomat, comments that come as Rubio has increasingly secured more responsibility and influence over the president during the second Trump administration.

Trump described Rubio’s guidance as he described his relationship with Chinese President Xi Jinping and shared an anecdote about how Xi requested that Trump stop referring to COVID-19 virus as the ‘China virus.’ According to Trump, Xi requested that the president use a different name – an ask that Trump said he chose to respect.

‘I decided to do that because why should we have a problem over that?’ Trump said at the World Economic Forum in Davos, Switzerland, Wednesday.

‘You were a true diplomat, huh?’ said Børge Brende, the president and CEO of the World Economic Forum.

‘I became a diplomat for the first time. Well, you know, taught me that? Marco Rubio. He said, ‘Let me teach you about diplomacy,’’ Trump said.

Trump has entrusted Rubio with a portfolio of responsibilities, and in addition to leading the State Department, Rubio also is serving as the national security advisor and head of the National Archives for the Trump administration. Rubio is the only person to oversee the White House’s National Security Council and lead the State Department since Henry Kissinger since the Nixon administration.

‘He’s just really smart, really effective, and he’s succeeded at everything he’s done,’ Matthew Kroenig, a former Pentagon official and current vice president at the Atlantic Council think tank, told Fox News Digital. ‘He doesn’t see his job as containing Trump. He understands who the boss is and channels those instincts into constructive directions.’

Rubio, who is the son of Cuban immigrants and previously served as a U.S. Senator representing Florida, has emerged as a key architect steering the Trump administration’s foreign policy agenda – gaining even more visibility after the U.S. launched strikes in Venezuela and captured dictator Nicolás Maduro on Jan. 3.

Rubio, who historically has espoused more hawkish foreign policy positions, had long supported overthrowing Maduro. The first Trump administration sought to oust the Venezuelan strongman by imposing sanctions on Venezuela and backing opposition leader Juan Guaidó.

In 2019, Rubio predicted Maduro’s fall — even though he was uncertain about the timeline.

‘He’s picked a battle he can’t win,’ Rubio said in an interview with The New York Times about Maduro. ‘It’s just a matter of time. The only thing we don’t know is how long it will take — and whether it will be peaceful or bloody.’

Following Maduro’s capture, Trump announced that the U.S. would ‘run’ Venezuela until a peaceful transition could occur. The move to ouster Maduro has attracted scrutiny, mostly from Democrats, who have called into question the legality of the operation in Venezuela, which was conducted without Congress’ approval.

Even so, Rubio has said that Congressional approval was not required since the operation was not an ‘invasion.’

Trump speculated in Switzerland that Rubio would be remembered as ‘the best’ Secretary of State, and noted that every single member of the Senate voted to confirm Rubio for his post in January 2025.

‘Hey, any guy that gets approved by 100% of the votes – you think of it, he got liberal Democrats and radical right Republicans to approve him,’ Trump said Wednesday. ‘He’s the only one…At first I wasn’t happy about it. I said, ‘Wait a minute, I don’t like that.’ And now it turns out that the Democrats probably wish they didn’t do that. And Marco has been fantastic.’

Fox News Digital reached out to the White House and Rubio for comment.

Fox News’ Morgan Phillips contributed to this report.