In the spring of 2022, Canadian teenager Markus Schouten’s dying wish was that no child should be forced to choose between life and death.

Markus had just learned he was about to die. His oncologist broke the news to him and his family on the eighth floor cancer ward at British Columbia Children’s Hospital in Vancouver, Canada. They held each other, weeping.

Weeks later, lying on his family’s living room sofa, Markus dictated a letter to the Canadian Parliament’s Special Joint Committee on Medical Assistance in Dying, established to set guidelines on a federal law that allowed ‘assisted suicide’ in Canada in 2016.

Markus opposed lobbying efforts to expand the law to children under the age of 18.

‘That’s because life is worth living and we should always work to alleviate suffering without eliminating the sufferer,’ read the final letter, which was signed by his parents.

The letter closed, ‘Life is worth living, even when we are dying.’

A month later, Markus died, surrounded by his family and friends, telling them, ‘See you in paradise.’

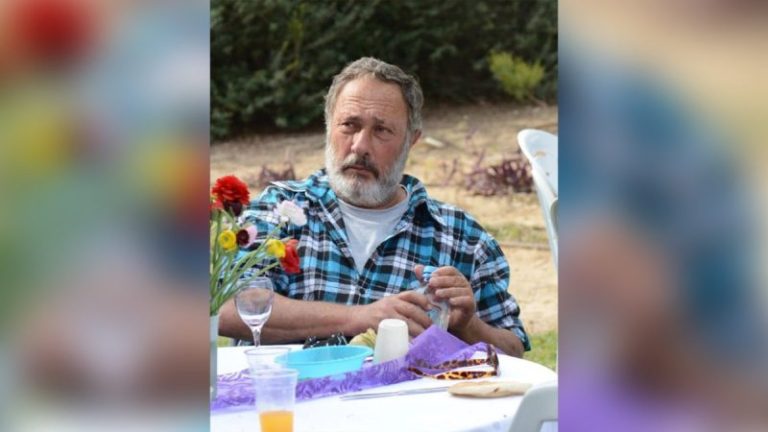

Three years later, his parents, Mike and Jennifer Schouten, are carrying the torch for Markus in a mission to block efforts to allow ‘mature minors’ the right to choose to die through assisted suicide. They now work alongside a global network of like-minded advocates, including disability rights groups, who argue the assisted-suicide industry targets vulnerable people who would benefit from assisted living services. Already, in Canada, the law is expected to expand to patients with severe psychiatric disorders, as early as 2027.

But they are up against a powerful, well-funded machine. A Fox Digital investigation reveals the Schoutens and other opponents of euthanasia face a multimillion-dollar global lobby that could be called Assisted Suicide Inc., a sprawling network changing laws worldwide, developing euthanasia services for funeral parlors, selling ‘suicide pods,’ promoting ‘suicide tourism’ and even training ‘doulas for death.’

‘As we continue to expand the euthanasia regime, all the safeguards and windows have gone out the window,’ said Mike Schouten. ‘And it becomes open season for anyone to choose death, including children.’

What began as a limited effort to provide adults with terminal illnesses the ability to end pain and suffering has now grown into an international industry. According to a database compiled by the Pearl Project, a nonprofit journalism initiative, at least 96 organizations worldwide are now part of this movement.

The global lobby cloaks assisted suicide in the language of civil rights and human rights, using euphemisms in their names, such as ‘assisted dying,’ ‘medical assistance in dying,’ ‘dying with dignity,’ ‘choice,’ ‘end of life,’ ‘completed life,’ ‘final exit,’ ‘free exit’ and the ‘right to die.’

These groups have a presence on every continent, but are predominately found in the West, which also faces alarmingly low birth rates. There are 41 groups in Europe; 31 groups in North America, with 25 of them in the United States, four in Canada and two in Mexico; 13 in Oceania, with most in Australia and one in New Zealand; and only five in Asia, two in Africa, and three in South America.

While most of their work has focused on adults, with Robert Munsch, the Canadian author of the best-selling children’s book, ‘Love You Forever,’ the latest high-profile person to recently announce he was approved for assisted suicide after being diagnosed with dementia. ‘Hello, Doc — come kill me!’ he joked, sharing the news.

The boundaries are shifting. Behind the push to extend these laws to children lies a legal Trojan horse: the ‘mature minor doctrine.’

This concept, first established in a 1967 Washington Supreme Court case, Smith v. Seibly, once allowed limited medical discretion for minors. But over decades, it has metastasized into a sweeping jurisdiction for granting children autonomy – and secrecy – over their medical decisions. Today, it lets minors make choices without parental involvement on gender pronouns, gender transitions, contraception and abortion. In 13 U.S. states and the District of Columbia, minors can even obtain abortions without parental knowledge.

Now, advocates are leveraging that same doctrine to argue that children should have the ‘medical autonomy’ to choose death. The ‘National Youth Rights Association,’ a 501(c)(3) nonprofit based in Hyattsville, Md., uses the ‘mature minors’ to die by physician-assisted suicide.

Euthanasia is already legal for adults in Australia, Belgium, Colombia, the Netherlands, New Zealand, Spain and 11 U.S. states. But three countries – the Netherlands, Belgium and Colombia – have gone further, allowing ‘mature minors’ to die by physician-assisted suicide.

In February 2023, despite the pleas of Marcus and his parents, Canada’s Special Joint Committee on Medical Assistance in Dying recommended extending the right to some youth, declaring that parents should be ‘consulted’ but that the ‘will of a minor’ with decision-making capacity ‘ultimately takes priority.’

The same debate has now reached the United Kingdom, where a bill to allow adult euthanasia is moving through the British Parliament. Earlier this year, the British House of Commons narrowly voted 259 to 216 to bar physicians from discussing assisted suicide with youth, meaning nearly half of lawmakers supported discussing assisted suicide for youth.

Katharine Birbalsingh, a British educator known as ‘Britain’s Strictest Headmistress,’ believes it’s only a matter of time before youth are included.

‘Assisted suicide will spread, full stop,’ she told Fox Digital. ‘And the people allowed to do assisted suicide will grow, making it younger and younger.’

Birbalsingh argues that Western societies have fallen for the dangerous illusion that ‘the child must lead,’ leading to thinking such as ‘Oh, he wants to change his gender, or he wants to commit suicide.’

‘Once upon a time,’ she said, ‘adults used to say, ‘No, the child is not capable of leading, because he is a child.‘ In the West, we have forgotten that we’re meant to be in charge as adults.’

‘There ‘s just a million reasons why young people would want to choose death,’ said Birbalsingh, the founder of the Michaela Community School in London. ‘You know, young people are compulsive, they make whimsical decisions. They make irresponsible decisions. They’re young. That’s sort of the definition of a child.’

‘That’s why they need looking after,’ Birbalsingh added. ‘That’s why we need to look after them as adults. That’s our job. It’s our role in life, to keep and protect them, sometimes from themselves. The people making these decisions just don’t understand young people.’ Lawmakers there was a ‘very real risk’ that proposed assisted suicide legislation, called the ‘Terminally Ill Adults (End of Life) Bill,’ would be expanded to include children if they didn’t vote for her amendment.

British Labour Party MP Meg Hillier voiced similar concerns during parliamentary debate, warning that teen brains make them particularly ‘susceptible to being influenced, including into dangerous and risky behavior.’

She said, ‘In a number of countries, assisted dying laws have been expanded to allow children and young people to end their lives. We need to be alert to that very real risk.’

Another MP, Sorcha Eastwood, cited social media’s toll on youth brain health, saying, ‘If we throw this into the mix, it has the potential to do untold damage.’

So far, pro-euthanasia groups in the U.S. have remained quiet about extending assisted suicide to minors, but critics fear it’s only a matter of time.

The British Children’s Commissioner, Dame Rachel de Souza, warned that the proposed changes would allow doctors to discuss assisted dying with 17-year-olds ‘deemed competent,’ preparing them for the choice upon turning 18. In a May report, she said that she had convened a panel of youth to discuss the issue.

In Canada, the euphemism ‘MAID,’ or ‘Medical Assistance In Dying,’ has softened the conversation. But the statistics are stark. In 2023, about 15,000 Canadians died through ‘MAID,’ about one in every 20 deaths nationwide, a 16% increase from 2022, making assisted suicide the fifth leading cause of death.

The movement is also big business. Dying with Dignity Canada, based in Toronto, reported $3 billion in expenses in 2024, including $803,555 for advertising and promotions. It publicly argues that ‘mature minors should be allowed the right to choose MAID,’ calling it ‘unfair’ to deny a 17-year-old what a 70-year-old is granted.

The British Columbia Humanist Association, the Canada chapter of Humanists International Inc., a 501(c)(3) nonprofit based in New York City, likewise demands MAID access for ‘mature minors’ and ‘those whose sole underlying condition is a mental illness,’ It insisting there is ‘no moral or ethical distinction between a mature minor and a young adult.’ It argues: ‘Ensure Dignity in Death.’ The ‘high priestess’ of euthanisia, Dr. Ellen Wiebe, also supports extending assisted suicide to children.

The Netherlands offers a preview of what comes next. Legal since 2002, Dutch euthanasia laws permit doctors to end lives of children as young as one, including newborns ‘suffering unbearably with no prospects of improvement.’

By 2024, euthanasia accounted for 9,958 deaths in 2024, or 5.8% of the country’s deaths.

A recent study published in the International Journal of Psychiatry found that among Dutch euthanasia applicants, 73% were young women with psychiatric diagnoses including major depression, autism, eating disorder, trauma-related disorders and a ‘history of suicidality.’ The researchers acknowledged there is an ‘urgent need’ to study ‘persistent death wishes’ in this ‘high-risk group.’

In one chilling case, a boy with autism, aged 16 to 18, ended his life after describing it as ‘joyless’ and ‘lonely,’ according to the 2024 annual report of the Regional Euthanasia Review Committees, which approves medical-assisted suicides. His doctor ‘had no doubt about his decisional competence.’

Last year, 14 Dutch psychiatrists urged prosecutors to investigate a case involving a 17-year-old girl, Milou, who died by euthanasia after years of depression, anxiety and suicidal ideation, following childhood sexual abuse. They warned against the ‘widespread promotion of euthanasia’ leading to ‘unnecessary deaths.’ The Royal Dutch Medical Association scolded the psychiatrists, and prosecutors declined to act.

In 2014, Belgium became the second country in the world to allow child euthanasia, requiring parental consent.The Belgian Federal Euthanasia Review and Evaluation Committee says that six youth have requested euthanasia between 2014 and 2024. Last year, one young person made the request.

The industry has faced allegedly criminal revelations. In Australia, one alleged ‘euthanasia ring kingpin,’ Brett Daniel Taylor, faces prison for selling vulnerable people lethal veterinary drugs nicknamed ‘the Green Dream.’

Back in Canada, Mike and Jennifer Schouten remain committed to fulfilling their son’s wish.

Michael remembers Markus lying on the sofa, dictating the words that became his son’s final message to lawmakers.

One day, in his final days, Markus said to his parents, ‘I can see what you are doing with your work is connected to what we’re going through. If we can share our story, we should.’

Now, Michael says, ‘I feel he is blessing our work.’

This story discusses suicide. If you or someone you know is having thoughts of suicide, please contact the Suicide & Crisis Lifeline at 988 or 1-800-273-TALK (8255).

This post appeared first on FOX NEWS